Why 2026 Car Prices Will Soar High Due to Tariffs

Have you heard from recent automotive news that the cost of an average new car has now reached $50,000 for the first time in history? Now that “Trump’s tariffs” are impacting profits, trade policies are tightening, and the cost of rare earth minerals are on the rise. The auto industry is turning into a tornado of issues, most of which are eventually transferred to the normal consumer. As manufacturers scurry to remain relevant in this environment, customers are questioning themselves about how far their pockets will stretch for the upcoming 2026 car prices.

Why Car Prices Are Increasing

The prices of vehicles in the car market have recently skyrocketed, which can be attributed to lingering global challenges. A few basic facts explain the increases in price.

- Tariff-Driven Production Costs:

Tariffs have shot up significantly in recent years, increasing production costs for car manufacturers. In response, they’ve had to raise prices to cover the growing expenses. Just look at the new 25% U.S. tariffs (introduced in 2025) have added over $6,000 in additional costs to smaller vehicles priced under $40,000. See Ford’s response to tariffs and recalls here. The result? Customers are footing the bill, paying higher prices for new vehicles.

This situation becomes even more pressing as automakers gear up to release 2026 models with new technologies and added features. These updates come with their own costs. The car industry now faces a critical challenge: finding a way to balance competitive pricing with these financial pressures. Manufacturers must figure out how to keep their new and future cars affordable while maintaining profitability. It’s a high-stakes balancing act.

- Supply Chain Disruptions:

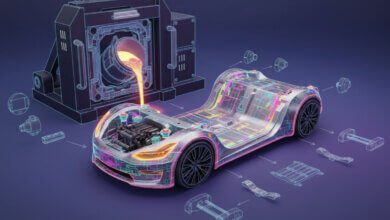

With the compounded effects of the pandemic, there are intricate disruptions in the world of logistics and supply chain management. This is especially true for the battery, which is the electric car’s most valuable asset, and the components it is made from. Moreover, there is a shortage of essential semiconductor craft. Not to mention the rising costs and delays in construction and machinery, which will diminish the overall value of vehicles.

- EV Development Costs and Competition

As auto regulations shift toward addressing climate change, car manufacturers are investing heavily in electric vehicles (EVs). While EVs are an exciting development for drivers, the cost of producing them has proven to be a massive obstacle for automakers. To encourage sales and reduce stock, some companies are providing incentives or discounting EVs—like Tesla’s recent price cuts, for instance—but these temporary promotions don’t make up for the surging development and production costs.

Global Trade Moves Affecting the Industry

Did you know? The auto industry’s economics are pretty sensitive to trade factors. Here is why.

➜ The Impact of Tariffs

Tariffs have made both imported and domestically manufactured vehicles more expensive. These trade measures are significantly raising the price of manufacturing, including materials like aluminum and steel. Looking to learn more? See how dealers are responding to trade uncertainties here.

On top of that, unpredictability in trade relations often frustrates manufacturers. It’s been a challenge to make accurate long-term business plans when unexpected tariffs increase costs without warning, leaving automakers to take the financial hit or pass it on to consumers.

➜ The Push for Localization

Global unpredictability is compelling producers toward localising production. This may diminish reliance on foreign suppliers, but it entails additional expenses involved in expanding local production facilities.

➜ Comparing U.S. and China’s Trends

China continues to be the world’s largest market for automobiles and is investing heavily in electric vehicles, which has resulted in intense competition on pricing. In contrast, U.S. automakers are still in the process of attempting to scale their electric vehicle offerings and are contending with costs. The differing approaches result in two fundamental pressures for the respective industries: China aims to capture market share while the U.S. aims for sustainability in pricing.

Leadership Shuffles in the Auto Industry

The rise of uncertainty has caused executives at OEMs and dealerships to review their strategies. From a management point of view, automakers are merging roles or changing teams to concentrate on primary areas:

- Sustainability Targets: With emissions and sustainability regulations set by the government, green movement initiatives have to be met.

- Strategic Partnerships: In the EV market, competition means you have to make alliances with tech and battery manufacturers. It’s a must.

- Cost Management: Boards and consumers have to moderate expectations while leaders deal with price, optimization, and labor manufacturing choices.

Dealerships require active steady leadership with respect to the sales and service teams. “Old business as usual” procedures have become obsolete as new initiatives are needed to counter the problems with new car sales.

What Consumers Can Do to Adapt

Every consumer has an obstacle to overcome. Such bottlenecks include high sticker prices, uncertainty, and uncovered EV costs. Here are the shifts and changes in behavior that consumers are slowly adapting:

♻️ Keeping Cars Longer: As noted in the industry observations, many consumers have decided to retain their vehicles longer than before. This is the result of disproportionate car prices and value-oriented choices.

♻️ Increased Investment in Vehicle Maintenance: Since vehicles have a longer lifespan, there’s an increasing demand for proper customer service and a “repair over replace” policy. This is where Fixed Operations offers a profitable proposition to dealerships.

Turning Challenges into Opportunities: Why Fixed Ops Is the Answer

Amidst a decline in vehicle sales, most dealerships are on a quest to find new ways to generate revenue. Fixed Operations could aid a dealership in rediscovering its profitability.

What Is Fixed Ops?

Vehicle servicing, maintenance, and spare parts sales all belong to the Fixed Ops division of a dealership. The Service Manager, Service Advisors, and Automotive Technicians are crucial to the company’s revenue and customer satisfaction.

What sets Fixed Ops apart is its unrivalled stability. While car sales are ever-changing, servicing and maintaining the cars remains constant, becoming even more of a necessity as the cars age.

Who We Are

Chris Collins is not the average “business consultant.” Chris devised a strategy to enhance Fixed Ops departments and restructure dealerships. He spent more than 25 years in the industry, authoring three best-selling books (Millionaire Service Advisor, Irreplaceable Service Manager, and Gamification), and developing a proven suite of customizable coaching programs. That’s why Chris Collins Inc. has gained such a great reputation.

How We Help Dealerships

✔ On-Demand Training: Our Service Drive Revolution programme focuses on accountability and teamwork in Fixed Ops. The Service Advisors, Service admin, and Technicians learn to fully strategise and work together.

✔ Process Optimisation for Service Departments: We apply proven methodologies to ensure employees work at peak productivity. They will, in turn, enhance customer satisfaction and retention.

✔ Building the Right Culture: It isn’t only about selling cars, a winning dealership culture is about forming trust and dependability through great service.

✔ Increased Revenue and Retention: More investment in Service Departments leads to more customer loyalty, increased profitability, and greater dealership value over time.

Conclusion

Indeed, every industry has its challenges, and for the automotive sector, it is the EV revolution, policy enforcement, and changing customer expectations, which are further complicated by tariffs. Reduced sale margins for new cars and fixed operations are still largely untapped profit opportunities. The Service Drive is still an unexplored savage territory.

At Chris Collins, Inc., we help dealerships maximize their utmost potential. From stronger teams and better service operations to processes that lead to real change, we have done it all. If you want to leverage the game, the best time to start investing in it is now.

Join the revolution today and book your 15-Minute Opportunity Analysis Call with us at +1 (800) 230-5165. Let’s start turning your challenges into success stories.

FAQs

Will 2026 new car launches be more expensive?

Definitely yes, like all manufacturers, automakers are likely to raise prices when a new model is introduced. Experts, however, expect only moderate price rises due to high demand and production costs, although they are likely to not completely address tariff impact.

What new cars are coming in 2026?

Some fresh models lined up for 2026 are the Longbow Speedster and Roadster, the Morgan Super Sport, the Genesis X Grand Berlinetta, and the Generelli LS60. These vehicles are exciting since they blend the classic internal combustion engine with hybrid and electric powertrains.

Which car is having the highest price?

If you think that Tesla price is the highest you can find. Well, according to 2025 reports, the most expensive car in the world is the Rolls-Royce La Rose Noire Droptail, retailing for 30 million dollars. It boasts extravagant artisan interiors paired with twin turbo V12 engines.